The government is ready to go further than the Flood Re scheme, but is your property covered?

With the torrential rain and hurricane-like winds sweeping over the UK in recent months targeting areas such as Surrey and Worcestershire, everyone is either afraid of their homes being a victim of flooding or trying to cope with day-to-day life with their living room turned into a swimming pool.

A hot topic is what insurance is available to them, how long it will take and whether the government are going to do any more to help with the water damage?

In the summer of 2012 the government introduced the Floor Re scheme to help owners of properties that are flood-prone, to buy cheap insurance. Buildings’ insurance will be capped to an estimated £210 and £540 for bands A & B and G respectively. Premiums will go towards a central pool of money and then be distributed to pay out claims. Sound good? The scheme doesn’t become active until 2015. Moreover, not everyone is covered. Properties in band H and those built from 2009 onwards are not covered. If your property is not in an area considered to be in high risk of flooding, it will also will not be covered.

So what of the current situation? Thousands of people are suffering from severe flooding and damage to property and a rising anger towards the government for what could be argued, a lack of speedy action and aid, has left victims feeling hopeless. Action seems to have sped up somewhat due to Thames flooding and halting many train journeys to and from London.

It has been suggested that insurance claims could potentially take up to several months to deal with over the coming year, due to the sheer amount of properties that have been damaged because of flooding. It would seem that the Labour party are vying for quicker action with Ed Miliband urging for a new industry standard to enable quicker pay-outs.

Either way, insurance companies have calculated that premiums will rise for the majority regardless of the Flood Re scheme applying annual caps.

It has been estimated that the total bill of payments could reach up to £1billion although David Cameron has stated that money is no objection when providing relief.

What can be deuced is that there is no clear answer, especially from the officials presiding over the community. Property damage is causing loss to business, disruption to everyday life, financial stress and anxiety and with party leaders arguing over what would be the most efficient strategy to deal with flooded properties, action to recover properties is certainly going to take some time.

Damp Proofing

Damp Proofing Basement Damp Proofing

Basement Damp Proofing Water Damage

Water Damage Condensation Control

Condensation Control Dry Rot Treatment

Dry Rot Treatment WOODWORM & WET ROT

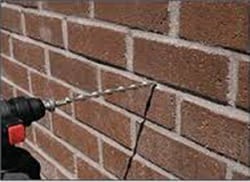

WOODWORM & WET ROT CAVITY Wall Ties

CAVITY Wall Ties Property Maintenance

Property Maintenance Waterproofing And Tanking

Waterproofing And Tanking Structural Repairs

Structural Repairs