Key Takeaways

Different property types and conditions require different surveys. From quick checks on newer homes to in-depth building and damp investigations, matching the survey type to your needs helps avoid costly surprises.

- RICS offers three main survey levels: Condition Report, HomeBuyer Report, Building Survey.

- Condition Report is a basic overview; Building Survey is the most detailed.

- Specialist damp/timber surveys focus on moisture and decay issues.

- Older, unusual, or renovated properties usually need more thorough surveys.

- Choosing correctly saves time, money, and stress after purchase.

Buying a home is one of the biggest decisions you can make and has a huge impact on your financial life. If something is wrong with the house, this is a big factor in the decision of whether or not to buy. But often there are problems you can’t see by looking at the house.

This is where a survey comes in. A survey is like a health check of a house that looks at a series of problems that could cost you money and gives you ideas about what it would cost to sort them out. Then you can decide if you are willing to buy the house in light of these issues or if you want to stop the process.

Is a survey compulsory when buying a house?

The first thing to know about surveys is that there’s no legal requirement to have one when you are buying a house. It isn’t compulsory but some mortgage companies may require one as their conditions of getting the mortgage. If they do, you have to pay for this.

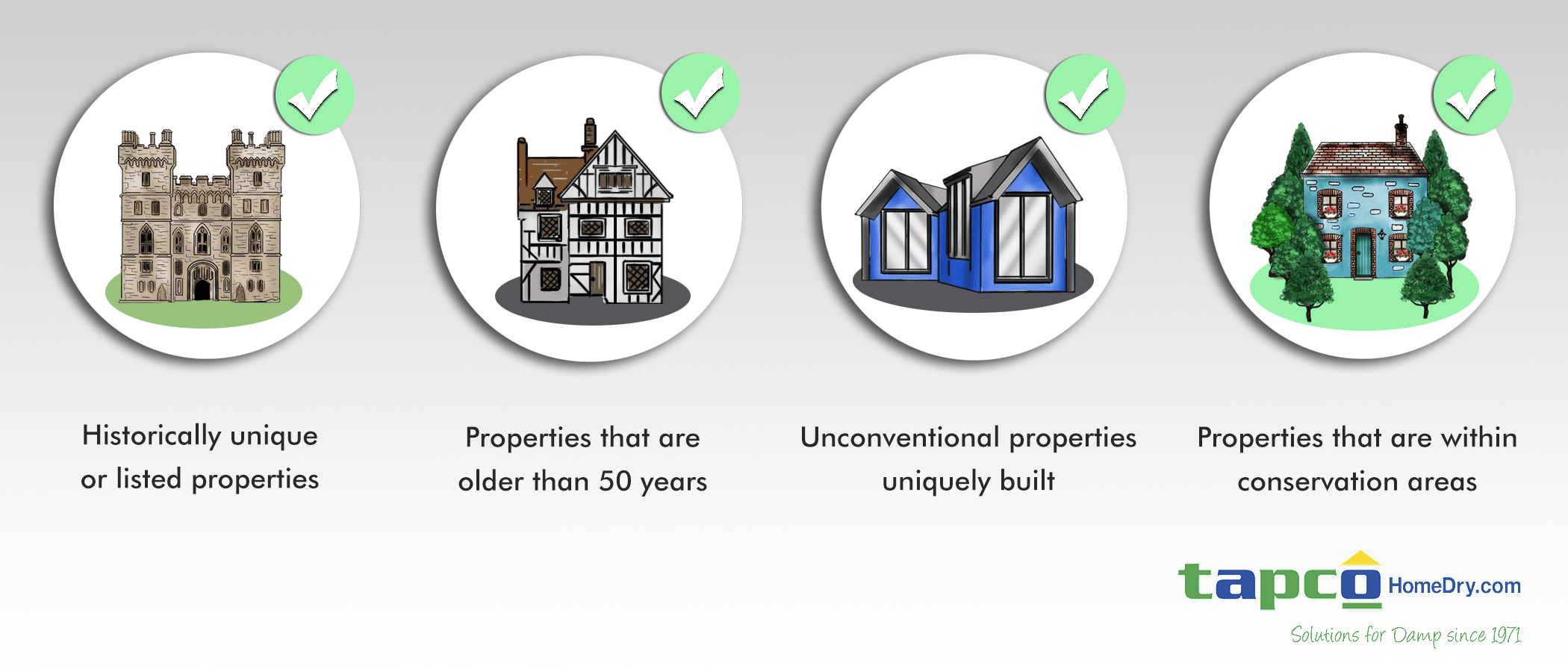

Surveys are definitely advisable, even if they aren’t compulsory. That’s because they can help you make an informed decision about a property and potentially spot series and costly issues. It is even more important if you are buying a house that is unusual in the structure, has elements like a thatched roof, a timber frame or is of a certain age. Listed buildings are also in this category.

Highlights

- RICS Level 1, Level 2, and Level 3 surveys explained.

- Condition Report: minimal detail, risk overview.

- HomeBuyer Report: adds valuation and moderate detail.

- Building Survey: full structural analysis and advice.

- Damp/timber surveys for targeted moisture checks.

- Match survey choice to age, style, and condition of home.

What types of survey are there?

A survey should be carried out by someone who is a member of a relevant governing body or who has a relevant qualification. For home surveys, this is usually the Royal Institute of Chartered Surveyors or RICS. There are three main types of home buyer surveys as well as specialist ones that look at particular problems.

Condition Report

A Condition Report is the most basic survey and the lowest in terms of cost. It takes up to two hours and you get a report usually the next day.

It looks at the basic condition of the house and any outbuildings such as garages. It checks services which are gas, electricity, water supply and drains and provides a rating using a traffic light system. It then also gives a summary of issues that a solicitor may advise you to look into further.

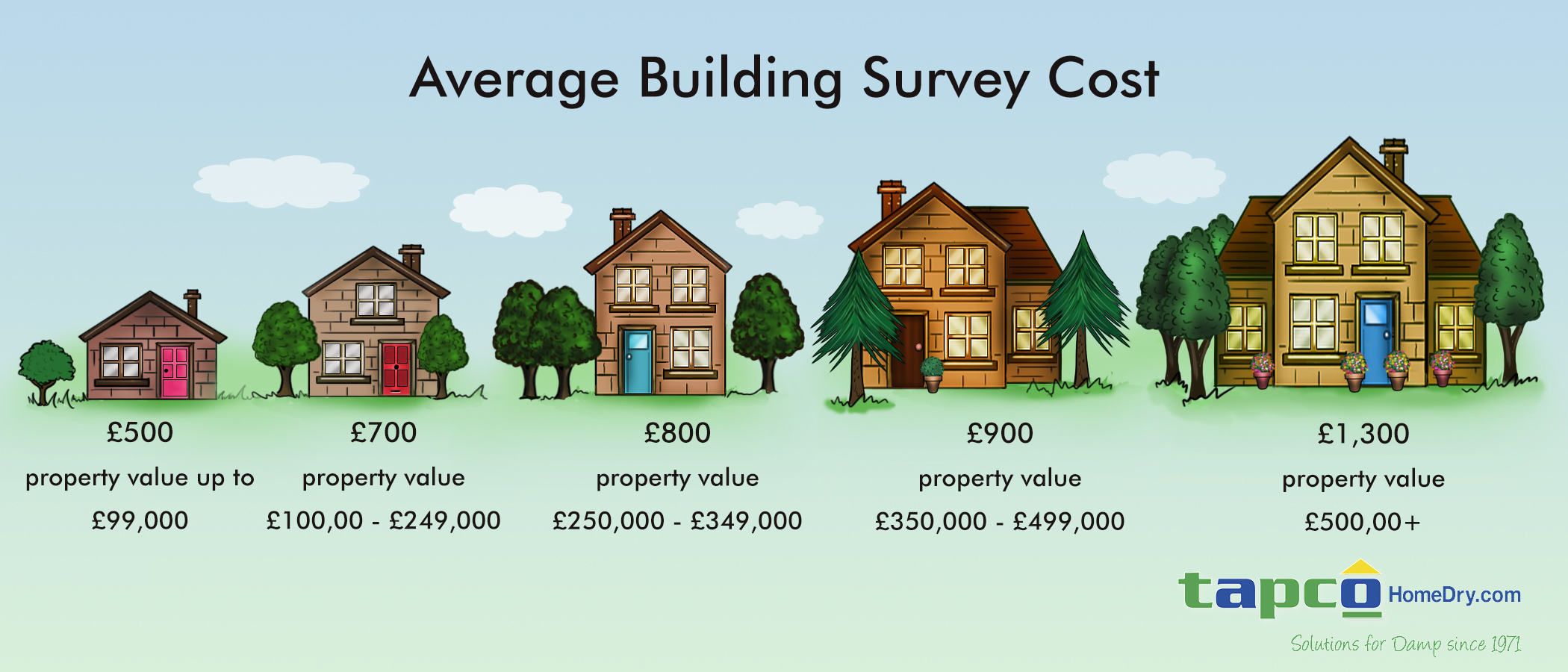

It costs around £300 and is ideal for newer properties or ones in good state of repair to give a broad overview of the property’s condition.

Homebuyer Report

There are two versions of the Homebuyer Report which is the next stage to the Condition Report. Both take around 2-3 hours to complete and a report is received within a day or two.

The survey-only Homebuyer Report costs around £350 and involves a detailed inspection of the visible parts of the property although not lifting floorboards or moving furniture. It includes details of things that impact the property’s value and what repairs and maintenance are needed as well as environment and energy issues and legal considerations.

The survey and valuation Homebuyer Report costs around another £100 and includes the rebuilding cost of the property for insurance as well as the current market value.

Both are good for modern and older homes in reasonable condition but where you want something more comprehensive than a Condition Report.

Building Survey

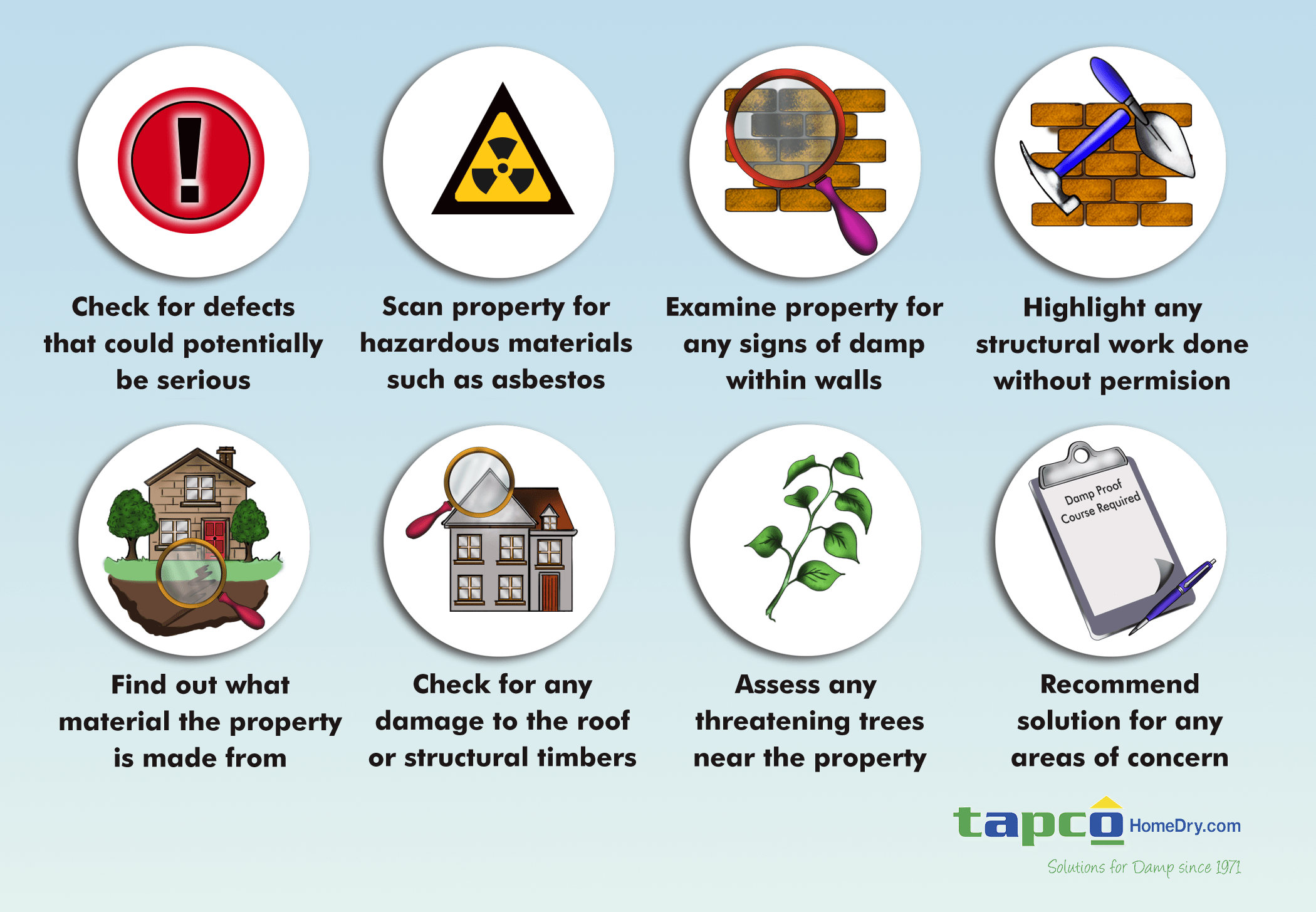

This is the most comprehensive type of survey and will cost from £500 upwards. It involves thoroughly inspecting the property and reporting on issues, summarising defects and potential problems. It offers advice on repair options, the costs involved and what might happen if they aren’t repaired.

It is ideal for larger, older, unusual or listed properties as well as those that need renovations or change of use, such as a barn conversion.

Tailor Your Survey

Survey choice should reflect the property’s condition, age, and complexity. A mismatched survey may overlook costly issues.

Specialist Insight

For properties with signs of damp or timber decay, a targeted survey ensures accurate diagnosis and repair planning alongside general inspection.

Damp survey

A damp survey is an example of a specialist type of survey that isn’t conducted by RICS but instead by qualified experts such as Tapco HomeDry investigations. This type of survey is specifically looking for damp problems or issues that could lead to damp as well as associated problems such as woodworm, wet and dry rot or defects that could lead to damp. It is important for older properties as well as ones showing any provisional signs of damp.

RPSA surveys

The RPSA or Residential Property Surveyors Association is another independent body that offers three types of survey. Their surveys all cover the following:

- Looking at damp, rot, woodworm or other major defects

- Product photo evidence of any problems

- Look at environmental issues that could affect the property

- Offer colour coded recommendations based on the importance

These surveys range from £400 to £900 depending on how much detail you want to have included.

Mi Surveys

Mi Surveys come in two types to look at modern types of property.

- Home Condition Survey – review of the property with major issues and defects photographed

- Building Survey – for an older or unusual property, offering a more detailed condition report, anticipated future performance of the property and around 40 photos.

Surveys in Scotland

The rules in Scotland are a little different from the rest of the UK. Here, most sellers are legally required to create a Home Report pack within 9 days of putting a house on the market. But you still may want to have a survey done if you have additional concerns that aren’t covered in this pack. Or there are some types of property such as Right to Buy or conversions that don’t require it.

The property survey will look at the valuation of the property and survey it, offer an Energy Report including the EPC (Energy Performance Certificate) and a questionnaire covering things such as electricity provider and council tax. The cost of this can be between £580 and £800.

A worthwhile expense

Because it isn’t compulsory, there’s the temptation to skip a survey but it is a worthwhile expense that can help you spot costly or disruptive problems. There are different types available and you can even go for a specialist one such as a damp survey if you are worried about a particular issue. But your future self will likely thank you for the steps you take before buying the house.

Damp Proofing

Damp Proofing Basement Damp Proofing

Basement Damp Proofing Water Damage

Water Damage Condensation Control

Condensation Control Dry Rot Treatment

Dry Rot Treatment WOODWORM & WET ROT

WOODWORM & WET ROT CAVITY Wall Ties

CAVITY Wall Ties Property Maintenance

Property Maintenance Waterproofing And Tanking

Waterproofing And Tanking Structural Repairs

Structural Repairs